In financial analysis, we use different ratios to understand how healthy and well a company is doing. One of these important ratios for checking short-term liquidity is called the "current ratio". This ratio compares a company's capacity to pay off its short-term debts against its current resources. In the upcoming section, we will be delving into the topic of the current ratio, including its formula and examples to make understanding clearer.

Importance of Liquidity

The concept of liquidity becomes crucial to assess the current ratio. Liquidity signifies a company's capability to fulfill its immediate commitments. In an active business setting, keeping sufficient liquidity is very important for running smoothly and maintaining financial stability. The current ratio is a very important measure of liquidity, giving information about how well a company can meet its short-term financial obligations.

Comprehending liquidity means more than just having enough cash. It also includes having assets that can be easily turned into cash without losing much value. Companies with good liquidity can handle sudden expenses or seize chances quickly. Additionally, when a company has a robust liquidity position, it boosts trustworthiness for both those who lend money and those who invest in the business. This kind of reliability makes access to capital markets easier and enhances relationships with creditors and investors alike.

- Timing of Cash Flows: Consider the timing of cash flows when assessing liquidity, as fluctuations in cash flow can impact a company's ability to meet its short-term obligations, even with a favorable current ratio.

- Working Capital Management: Efficient working capital management is essential for maintaining liquidity. Companies must strike a balance between minimizing excess liquidity and ensuring adequate reserves to meet obligations.

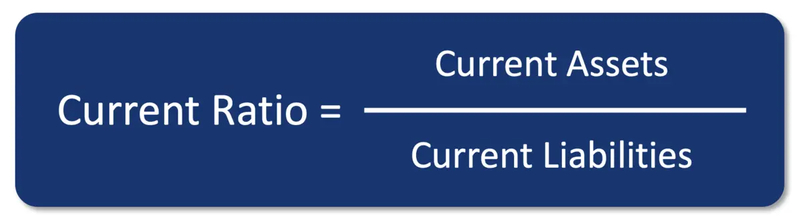

Understanding the Formula

The current ratio is calculated by dividing a company's current assets by its current liabilities. Mathematically expressed as Current Ratio = Current Assets/ Current Liabilities. The usual possible values for current assets are cash, accounts receivable (money owed to the company from customers), stock that's available to sell, and short-term investments. Additionally, the concept of current liabilities includes duties that must be fulfilled in a year or less. This covers various things like accounts payable, short-term debt, and accrued expenses. By comparing these numbers, we can understand if a company has enough short-term resources to meet its immediate debts.

Computing the current ratio gives a quick look into how much money a company has and can turn quickly to pay its immediate debts. However, it is crucial to understand that the types of assets and liabilities included in the current category can differ across various industries or companies. For example, a service-focused business might possess fewer inventory-based current assets in contrast to one involved in manufacturing activities. So, when we interpret the current ratio, it's important to think about what kind of business it is and how long its operations take.

- Nature of Assets: Consider the composition of current assets, as assets like inventory may have different liquidity characteristics. Highly liquid assets like cash and marketable securities contribute more effectively to liquidity than slow-moving inventory.

- Seasonality: Seasonal fluctuations in business operations can impact the current ratio. For industries with pronounced seasonal trends, it's essential to analyze liquidity over multiple periods to capture variations accurately.

Interpreting the Ratio

A current ratio of more than 1 means that a company has more current assets compared to its current liabilities. This shows the company can handle its short-term duties without problems. A very high ratio might suggest less use of assets, showing there is inefficiency in managing these things. On the other hand, a current ratio of less than 1 could suggest possible problems with liquidity. This may mean the company could have difficulty meeting its short-term debts.

Although the existing ratio gives useful information on liquidity, it's necessary to study different financial measurements for a complete analysis. For instance, a high current ratio may mean careful handling of finances; but it can also show an inability to make good use of assets. Hence, investors and researchers must evaluate the current ratio along with other metrics like quick ratio, cash conversion cycle, or working capital turnover to comprehend the company's liquidity position better.

- Debt Maturity: Analyze the maturity profile of current liabilities to assess the sustainability of the current ratio. A high proportion of short-term debt may increase refinancing risk, impacting liquidity.

- Trends Over Time: Monitor changes in the current ratio over time to identify emerging liquidity trends. Consistent improvement or deterioration in the ratio may signal underlying operational or financial challenges.

Real-World Examples

To better understand the application of the current ratio, let's consider two hypothetical companies, A and B. Company A has current assets worth $500,000 and current liabilities amounting to $300,000. Using the formula, we calculate its current ratio as follows: Current Ratio for A = $ 500,000/ $ 300,000 = 1.67. This indicates that Company A has $1.67 in current assets for every dollar of current liabilities, reflecting a healthy liquidity position. In contrast, Company B has current assets of $200,000 and current liabilities totaling $250,000. Calculating its current ratio: Current Ratio for B = $ 200,000/$250,000 = 0.8 Here, Company B's current ratio falls below 1, signaling potential liquidity concerns as its current assets are insufficient to cover immediate liabilities.

When using the current ratio as a tool for decision-making, it's crucial to consider the industry norms and the company's specific circumstances. Industries with different capital structures and operating models might have varying acceptable ranges for current ratios. Moreover, temporary fluctuations in current assets or liabilities might skew the ratio, so it's essential to analyze trends over time rather than relying solely on a single data point.

- Industry Standards: Keep in mind the typical current ratio for the industry the company operates in, as this can vary significantly.

- Trend Analysis: Look at historical data and trends to understand if current ratios are improving or deteriorating over time, providing a more comprehensive view of decision-making.

Limitations and Considerations

Although the current ratio gives us important information about liquidity, it also has some drawbacks. For example, this ratio doesn't take into account the type or quality of assets and when cash will come in. Industries could have different acceptable levels for their current ratios, so comparing them across sectors may be difficult. So, understanding the current ratio needs comparison to industry standards and looking at other financial measures for a full analysis.

The simplicity of the current ratio can also be a disadvantage in some situations. For instance, it views all current assets and liabilities as being equally important without considering their varying levels of liquidity or urgency. Furthermore, changes in revenue recognition practices or inventory management strategies might occasionally cause shifts within the current ratio that are not related to liquidity changes. Thus, analysts must be careful to not only depend on the current ratio. They should also add qualitative judgments about the company's operations and market setting in their analysis.

- Non-Liquid Assets: Consider the liquidity of individual assets within the current asset category, as not all assets are equally liquid. For example, while cash is highly liquid, inventory may take time to convert into cash and may be subject to obsolescence or valuation adjustments.

- Industry Dynamics: Industry-specific factors can influence the interpretation of the current ratio. For instance, industries with longer cash conversion cycles, such as manufacturing or retail, may naturally have lower current ratios compared to service-oriented businesses. Understanding industry benchmarks is essential for meaningful analysis.

Conclusion

The current ratio, as a basic instrument in financial analysis, gives an important understanding of a company's capability for immediate liquidity. The formula of the current ratio and how it is applied to interpret actual cases can help investors and analysts evaluate if a firm can fulfill its short-term responsibilities. But this method has some restrictions which should be acknowledged. It is advisable to combine the study of other financial measures with the current ratio to get a complete picture of a company's monetary condition.