Index funds are a type of mutual fund that have become very popular, they offer a simple way to create a diverse portfolio. These funds follow certain market indexes, like the S&P 500 or NASDAQ Composite, and try to replicate their performance. Index funds give investors a chance to invest in a wide range of assets represented by the index, allowing them exposure across different areas in the economy. In this guide, we will study the details of index funds, their advantages, and how they function in finance.

The Concept Behind Index Funds

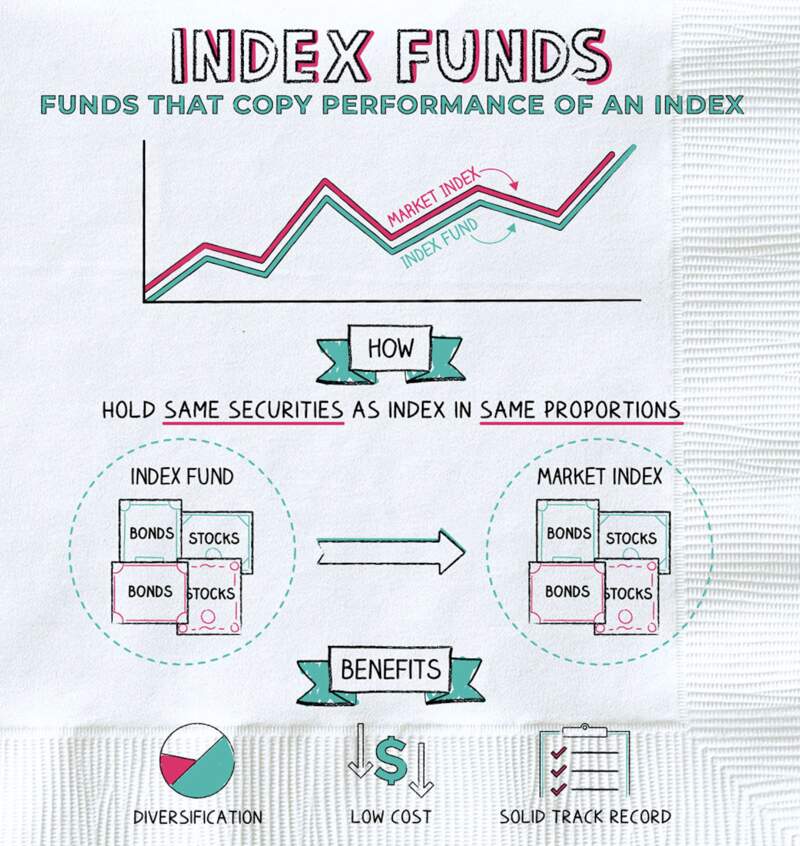

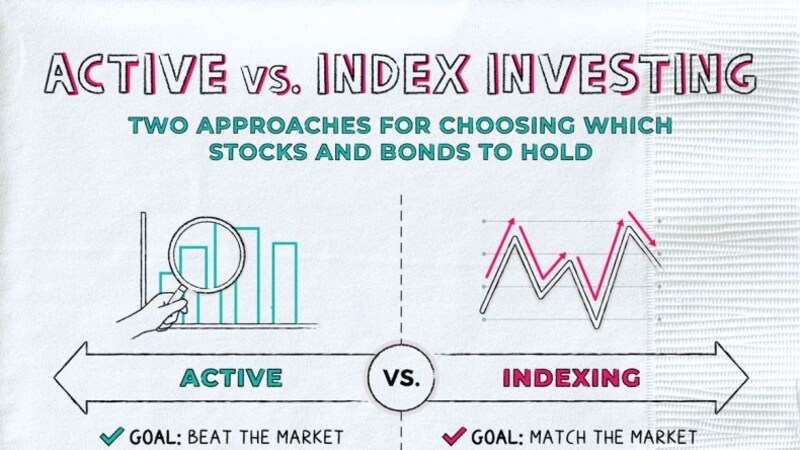

Index funds work based on the idea of passive investing, which is different from active management where fund managers make decisions to perform better than the market. Rather than attempting to outdo the market, index funds aim to align with its performance. They do this by maintaining a group of assets that reflects an index's makeup. The value of an index fund is not fixed, it changes as the index value fluctuates. The purpose is to give investors returns that are similar to those of the base index.

Index funds act as a steady base for the portfolio of investors. The method they use, known as passive management, results in lesser charges because it does not demand continuous trading. Additionally, this method lessens the danger linked to mistakes humans make in deciding what to trade. As an index fund only copies the index itself. Index funds master the efficient market hypothesis by using the power of collective market knowledge to attain consistent growth in the long term.

- Efficient Market Hypothesis: Index funds operate on the premise that markets are efficient and all available information is reflected in asset prices. This hypothesis suggests that it's challenging to consistently outperform the market, making passive investing an attractive strategy for many investors.

- Risk Mitigation: With index funds, investors benefit from diversification across a broad range of assets, reducing the impact of volatility in any single security. This risk mitigation strategy is particularly valuable during turbulent market conditions.

Key Features of Index Funds

The traits of index funds are simple. These funds give you wide market exposure because they invest in all or most of the securities that make up the index you choose. They often have low expense ratios when compared to actively managed funds because they need little management. This signifies they are a low-cost choice for investors. Also, index funds usually have good tax efficiency because their portfolio turnover is less than that of actively managed funds which leads to lesser capital gains distributions.

Index funds are known for their transparent and simple structure. They offer a passive strategy that involves minimal turnover in holdings, resulting in less transaction costs and tax effects. These funds are very liquid, making it simple for investors to buy or sell shares at market value without any concerns about liquidity issues.

- Transparency: Unlike actively managed funds, index funds disclose their holdings regularly, providing investors with transparency into the underlying assets. This transparency enables investors to make informed decisions based on the fund's composition and strategy.

- Liquidity: Index funds trade on major exchanges like stocks, offering high liquidity to investors. This liquidity ensures that investors can easily buy or sell shares at prevailing market prices, enhancing flexibility in portfolio management.

Benefits of Investing in Index Funds

Contribute to diversification: An index fund typically comprises a variety of assets, therefore by investing in one fund you are essentially spreading your risk across different sectors or industries. This can help to mitigate the impact of any unfortunate events that may occur within a particular sector. This aids in lessening the blow of instability in a certain market area. Another advantage is that index funds typically do better than actively managed funds for extended periods, mainly because they have lesser costs and steady performance matching the base index.

Index funds are perfect for investing with little intervention, which makes them appropriate for beginners as well as experienced investors. Their cheap cost and wide market coverage make index funds an appealing choice to build wealth over time. Furthermore, index funds give a sense of calm to investors because they know their investments match up with the overall market performance.

- Accessibility: Index funds are accessible to investors of all levels, offering a simple way to participate in the financial markets. Whether investors have a small or large budget, they can easily purchase shares of an index fund, making it a versatile investment option.

- Consistent Performance: Over time, index funds have demonstrated consistent performance relative to their benchmark indexes. This reliability reassures investors of achieving steady returns aligned with market trends.

How Index Funds Work in Practice

Index funds work by trying to imitate the performance of a particular market index. The fund managers do this by investing in the same securities that are held within that index, and in equal proportions as well. If we take the example of an S&P 500 index fund, it would have stocks from all 500 companies listed on the S&P 500 index with weightage based on market capitalization. When the index composition alters, for instance through stock splits or corporate actions, the fund makes changes to its holdings so they continue matching with the index.

Index funds follow a "buy and hold" method, meaning they do less trading to match the underlying index. This helps to lower the expenses from transactions and capital gains taxes, increasing returns for investors in total. Furthermore, index funds are easy and clear which makes them appropriate for passive investors who want long-term growth chances.

- Buy and Hold Strategy: Index funds adopt a buy and hold approach, aiming to replicate the performance of the underlying index over time. This strategy reduces trading costs and taxes associated with frequent buying and selling of securities.

- Rebalancing: Fund managers periodically rebalance index funds to maintain alignment with the index's composition. This process involves buying or selling assets to ensure that the fund's holdings reflect the current weights of the index components.

Considerations for Investors

While index funds offer many benefits, investors should consider certain factors before investing. One consideration is the choice of index to track. Different indexes represent different segments of the market, each with its risk-return profile. Investors should select an index that aligns with their investment goals and risk tolerance. Additionally, investors should be mindful of fees and expenses associated with index funds, as these can erode returns over time. Finally, it's important to maintain a long-term perspective when investing in index funds, as they are designed to deliver returns over extended periods.

Investors should evaluate their investment objectives and risk tolerance before committing to index funds. Additionally, they should assess the fund's tracking error, which measures how closely the fund's performance matches that of the underlying index. Moreover, investors should monitor the fund's expense ratio, ensuring that it remains competitive compared to other index funds in the market.

- Tracking Error: Investors should analyze the tracking error of an index fund, which indicates the deviation of the fund's returns from the returns of the underlying index. Lower tracking error signifies better alignment with the index's performance.

- Expense Ratio Comparison: Comparing the expense ratios of different index funds can help investors identify cost-effective options. A lower expense ratio translates to higher net returns for investors, making it an important factor to consider.

Conclusion

Index funds are simple and low-cost options for investors to get involved in different market segments. These funds follow a specific index, giving wide-ranging diversification, low expenses, and tax effectiveness. Even if they may not perform better than the market in one year, their steady results over many years make them an important part of any investment collection. Know-how on how index funds work and their place in finance can give investors the confidence to make wise choices, helping them reach their financial aims.